Our 2021/22 materiality assessment engaged stakeholders to shape our ESG approach and targets up to 2025. We have now built on this approach to conduct our refreshed assessment to meet stakeholders’ expectations and adhere to both financial and impact materiality principles in-line with best practice. By applying a double materiality lens, we are assessing both the impact of material topics to Pennon and our wider environmental and social impact on these topics. This will ensure that our future ESG approach looking ahead to 2030 and beyond is ambitious, relevant, and aligned with the evolving regulatory and global sustainability trends today.

In the absence of UK-specific guidance under the forthcoming UK Sustainability Reporting Standards (UK SRS), we conducted our DMA using the European Sustainability Reporting Standards (ESRS) topic structure. This ensures alignment with current best practice and enhances consistency and comparability across our sector and beyond.

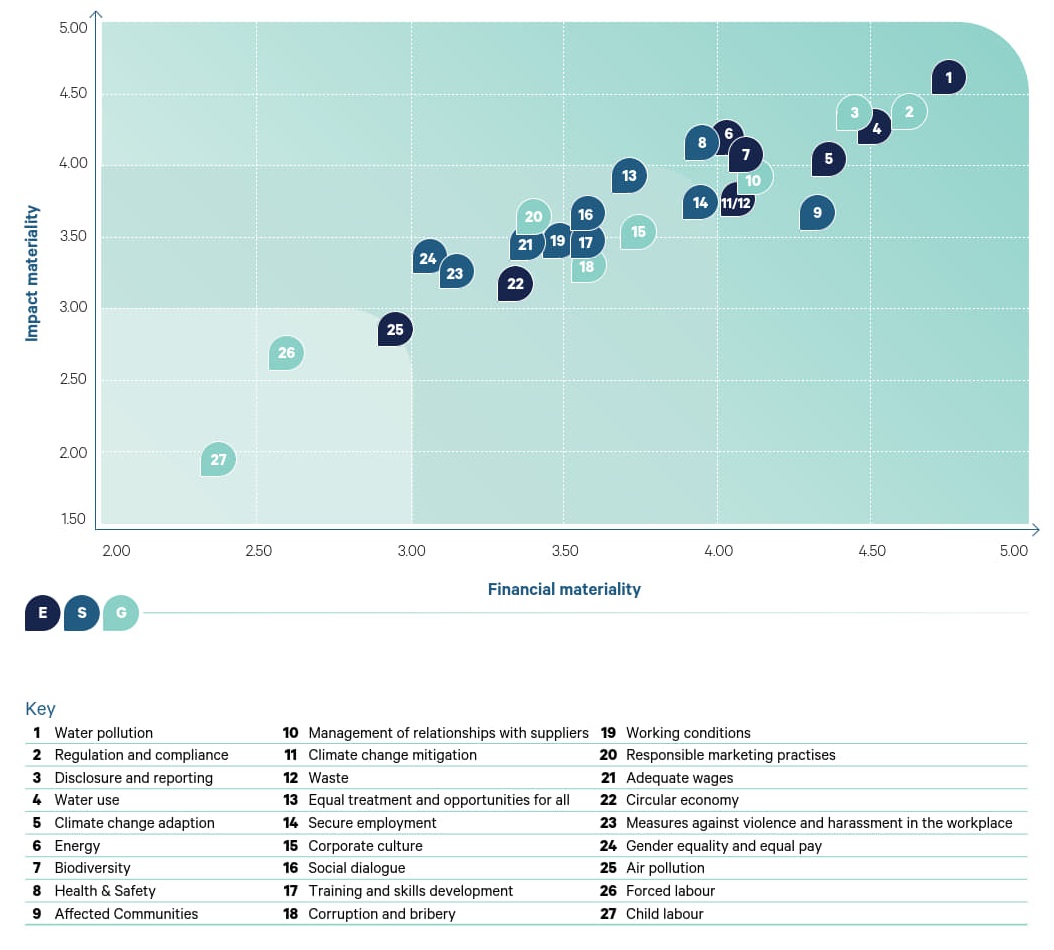

The following Materiality Matrix presents the quantitative results of our double materiality assessment (DMA), highlighting the ESG topics that stakeholders consider most material. The matrix visualises each topic based on two dimensions: impact materiality (Y-axis), reflecting the significance of Pennon Group’s impact on people and the environment, and financial materiality (X-axis), indicating the potential influence of each topic on our business operations and financial performance. Topics are colour-coded and listed below by Environmental, Social, and Governance (E, S, G) themes to provide a clear and structured view of our priority areas.

The results of our double materiality assessment reaffirm the priority ESG issues identified in our 2021/22 assessment and align strongly with the four strategic priorities that underpin our 2025-2030 Business Plan. This alignment highlights the consistency and relevance of the issues that matter most to both our stakeholders and our business. Topics such as water pollution, regulation and compliance, disclosure and reporting, water use, and climate change adaptation emerged as top priorities, reflecting the unique responsibilities and risks faced by our sector. These core areas closely align with our longstanding focus on net zero, freshwater stewardship, and building trust through transparency. The sustained importance of these issues strengthens our confidence in the direction of our ESG strategy and our ongoing commitments and actions as we look ahead to 2030 and beyond.