Pennon firmly believes that good corporate governance is essential to enable us to deliver our purpose for all our stakeholders and it remains a top priority for the Board. The Company is committed to the principles of the 2018 UK Corporate Governance Code (the Code), which is published on the Financial Reporting Council (FRC) website. As a responsible business, our activities are underpinned by strong governance frameworks that uphold our core values within the organisation and throughout our supply chain. We are committed to providing open, honest and transparent reporting, and measure ourselves against both national and international benchmarks of responsible business practice.

Trust and transparency are one of our highest material issues, therefore we will continue regular dialogue with stakeholders, to build open and meaningful relationships. We have reinforced our supply chain resilience by becoming a partner of the Supply Chain Sustainability School (SCSS), reinforcing our commitment to upskilling our supply chain and colleagues across key sustainability topics. In addition, we have built on our ESG Targets to drive performance to 2030, further strengthening our commitment to the importance we place on those we work with sharing our core ESG values. As a Group, we have demonstrated our sustainability commitments with short and long-term pathways to emissions reduction, to drive innovation and support our long-term strategy.

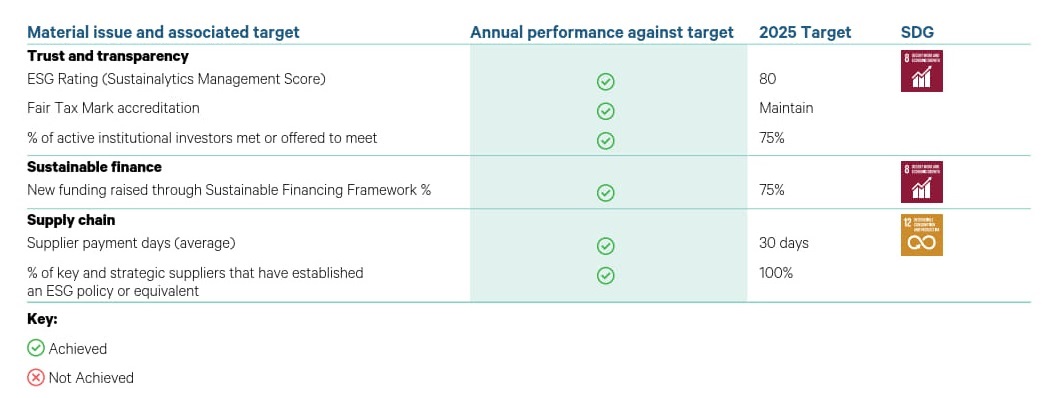

We monitor our performance across a range of Governance-related ESG targets, with all targets achieved in 2024/25:

Strong governance provides the framework for effective strategy delivery, value creation for stakeholders, and sustainable business development at Pennon Group. Our approach to governance is ingrained in our culture, guided by the Code of Conduct that sets principles for employee decision-making.

Last year, we launched our new group values: Be You, Be Rock Solid and Be the Future. These values serve as guiding principles that shape our interactions with customers, communities and each other. They give us a framework for how we should engage as a team, and help us build a foundation for growth and trust, and a positive workplace environment. Over this past year, we have worked hard to embed these values, using them as a tool to align our teams as we prepare the business for AMP8 and to deliver on our strategic priorities.

We operate to the highest corporate governance standards, with governance central to successful Group management, strategy execution, purpose fulfilment, stakeholder value creation, and continuous business development. The Board maintains effective governance and integrity for long-term stakeholder benefit. Separate boards for Pennon and Southwest Water ensure operational oversight and efficient decision-making processes, aligning with Ofwat's principles. The Environmental, Social and Governance (ESG) Committee scrutinizes ESG performance and oversees Pennon's ESG targets. As a UN Global Compact signatory, we embed its principles on human rights, labour, environment, and anti-corruption into our ESG approach and annually report progress. Pennon is also actively involved in Business in the Community, FTSE4Good Index, and other leading ESG assessments, with metrics, policies, and assurance statements available in our ESG Databook , and on the External Benchmarking tab.

As a large organisation with an extensive and diverse supply chain, we are deeply committed to ensuring our supply chain partners align with the same values, standards, and sustainable practices that we uphold. The ESG Committee has thoroughly evaluated our supply chain processes to embed sustainability principles throughout our operations. Looking ahead, we are focused on bolstering the wider supply chain delivery through our Amplify initiative, which includes a two-tier supplier model supporting numerous projects and contributing to our substantial investment in the region. We have segmented our supply base to maximise engagement with each partner, utilising methods such as supplier audits, a Code of Conduct, sustainable procurement policies, formal agreements, and e-procurement platforms.

Our major Amplify alliance with leading engineering companies aims to drive significant investment in the local economy, creating thousands of new jobs while delivering critical infrastructure projects as part of our commitment to customers, communities, and the environment. We prioritise working with businesses that demonstrate good and sustainable practices, adhering to stringent procurement policies and favouring local suppliers to provide employment and community benefits.

All suppliers must comply with our Code of Conduct for Supply Chain Partners. As a signatory to the EU Skills Accord, we collaborate to support skills development and investment throughout the supply chain. Additionally, we have become a partner of the Supply Chain Sustainability School (SCSS), reinforcing our commitment to upskilling our supply chain and colleagues across key sustainability topics. Also, through our ESG and Net Zero strategies, we engage our supply chain to better understand and manage our collective environmental impact through collaboration.

For more detailed Supply Chain metrics including the way we embed ESG across our suppliers, visit the “Supply Chain” section of the ESG Databook.

Our approach to ESG affects not only our operations and the way we carry out our business, but the way in which we finance our business. Pennon’s Sustainable Financing Framework aims to integrate commitments to environmental and social objectives into funding activities.

The group has been awarded the Fair Tax Mark for the seventh year in a row making it the longest water-based business to hold this accreditation. The Fair Tax Mark accreditation scheme is the gold standard of responsible tax conduct. It seeks to encourage and recognise organisations that pay the right amount of corporation tax at the right time and in the right place. Pennon takes its responsibility to transparency and societal contribution seriously which includes ensuring it pays the right amount of tax, in the right way, at the right time and this year received its highest ever score.

Looking ahead to 2030, we have an ESG Target to raise a further £2bn via our Sustainable Financing Framework to help fund our record level investment plans, delivering sustainable outcomes across our operating regions.

Pennon Group has a comprehensive and confidential whistleblowing process overseen by the Executive-led Ethics Management Committee. All individuals associated with the Group must follow the Anti-financial Crime Policy and are encouraged to report any concerns anonymously through the "Speak Up" whistleblowing portal provided by a third-party.

The Whistleblowing Policy outlines clear procedures for employees and suppliers to raise concerns either with their manager or through an independent hotline. This policy is well-communicated across the organisation. Significant whistleblowing issues raised are formally investigated. Findings are shared with the Audit Committee, Ethics Management Committee, and ultimately reported to the Board who oversee the Whistleblowing Policy. The Board receives annual whistleblowing updates summarising issues raised and interim updates on significant matters, while protecting anonymity. Pennon Group fosters an environment where concerns can be safely raised and properly addressed. The Board is satisfied with the effectiveness of the Whistleblowing Policy and the Ethics Management Committee in upholding ethical conduct and accountability within the Group.